What £1.5m really buys you in London

Spoiler: it's probably not a 'mansion'

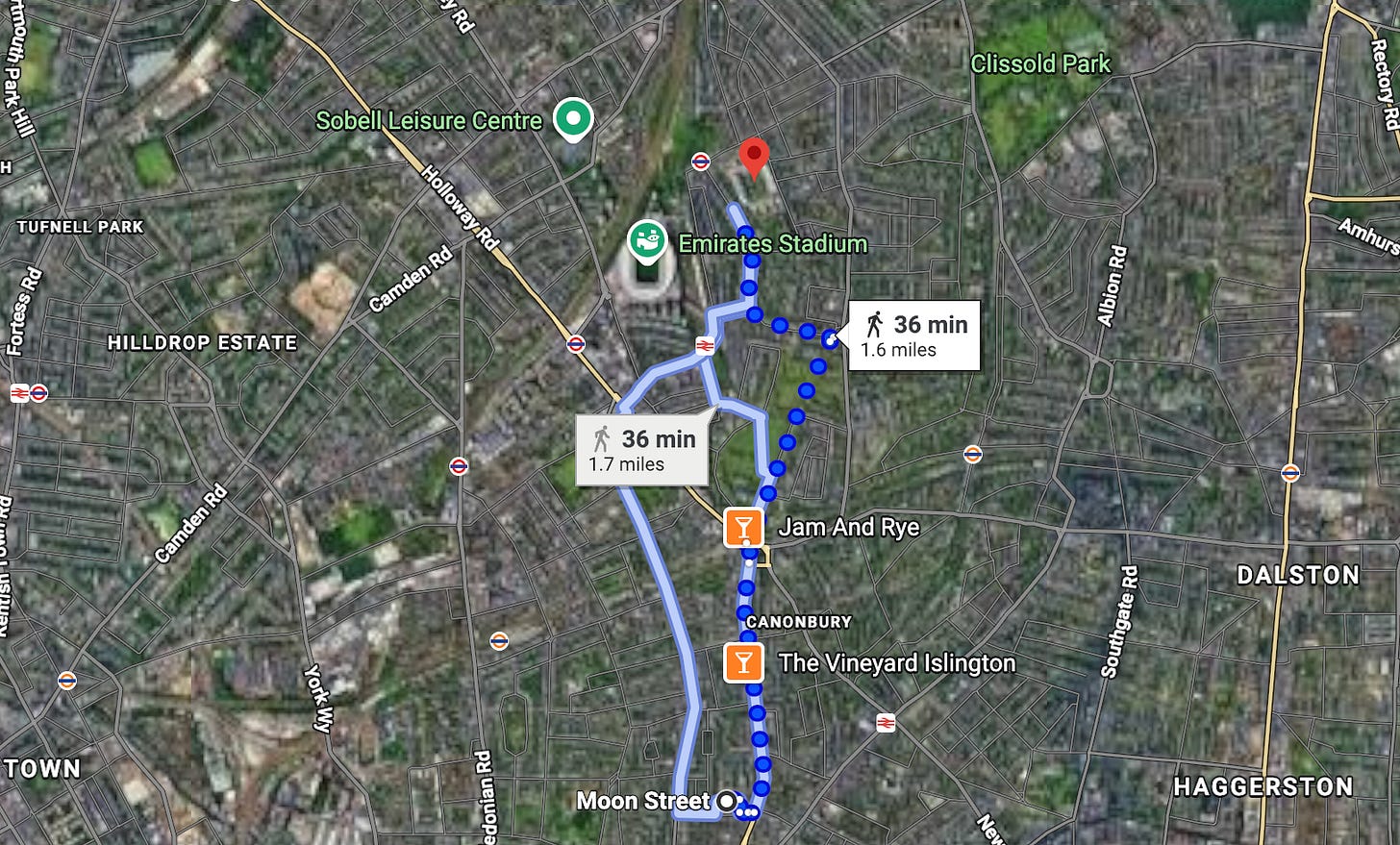

My Dad had one criterion when it came to buying his first home: that it be within walking distance of Arsenal’s Highbury Stadium. Consequently, he settled in Moon Street, a charming residential road just off Upper Street in the heart of Islington. Now, this was the mid-1970s, so the area wasn’t quite the ultra-desirable spot it is today, replete with French brasseries, indie cinemas and leafy squares.

Back then, it was an area in transition. Parts of the borough still hosted light industry, workshops and warehouses. Meanwhile, many of the large Georgian houses — now worth many millions — were often run-down and subdivided into bedsits. As a result, property was cheap.

I don’t have the Land Registry details to hand, but he purchased a terrace (a terrace!) for something in the region of £7,000, before selling a few years later for close to £14,000. Hey, doubling your money is nothing to sniff at. Fast forward to 2025 and you’d be doing well to see any change out of £7,000 to pay for your conveyancer, surveyor and local authority searches.

Labour taxes its own voters

Turning briefly to the other great male role model in my life, the historian Stephen Kotkin. As the biographer of Joseph Stalin, Kotkin has probably spent more time reading Soviet archives than anyone alive today. His central finding from decades of research? “They were communists.” Seriously. What he meant was that the leading members of the politburo weren’t mere cynics paying lip service to Marxist-Leninist screeds. They really believed in it!

So, too, did David Cameron. Albeit in his case, conservatism. Back in 2012, the then-prime minister ruled out a mansion tax, something his Liberal Democrat coalition partners were calling for. He actually came closer than you might think to supporting one, and his chancellor did raise stamp duty rates on more expensive homes. But a mansion tax was a betrayal too far. Cameron really was a Tory.

He also knew who his voters were. As part of its “smorgasbord” Budget, the government is expected to institute a mansion tax of its own (energy freezes, mansion taxes, controls on immigration — it’s Ed Miliband’s world, and we’re just living in it). The question is, as ever, who should pay it.

The problem is obvious. The lower the point at which the tax is set, the more people will pay it and the more revenue the policy will raise. But at the same time, the lower it is set, the more people will have to pay it! Features editors across the land are already calling up grannies in Camberwell who can’t afford the charge. Worse still, many of those on the hook will be Labour voters, who don’t necessarily consider their homes to be mansions.

So we have a number of problems. Labour is set to tax its own voters in the capital, (where polling suggests the party is going to face an absolute shellacking at next year’s local elections). Oh, and London’s house prices are currently falling, which is having a negative impact not only on consumer confidence, but also on developers’ appetite to build new homes, a policy which lies at the cornerstone of this government’s agenda.

But none of this is my problem. I don’t own a house, nor did I run for office on a policy of not raising taxes on working people or building 1.5 million homes over the course of a parliament. Instead, I thought I could add most value here by injecting a little fun into the Budget process. Because while £1.5m may be a lot of money, it does not necessarily buy you a lot of house in the capital. Here are some of my favourite examples:

Keep reading with a 7-day free trial

Subscribe to Lines To Take to keep reading this post and get 7 days of free access to the full post archives.