The 'bond market chancellor' blinks

Income tax retreat threatens Rachel Reeves' hard-earned reputation

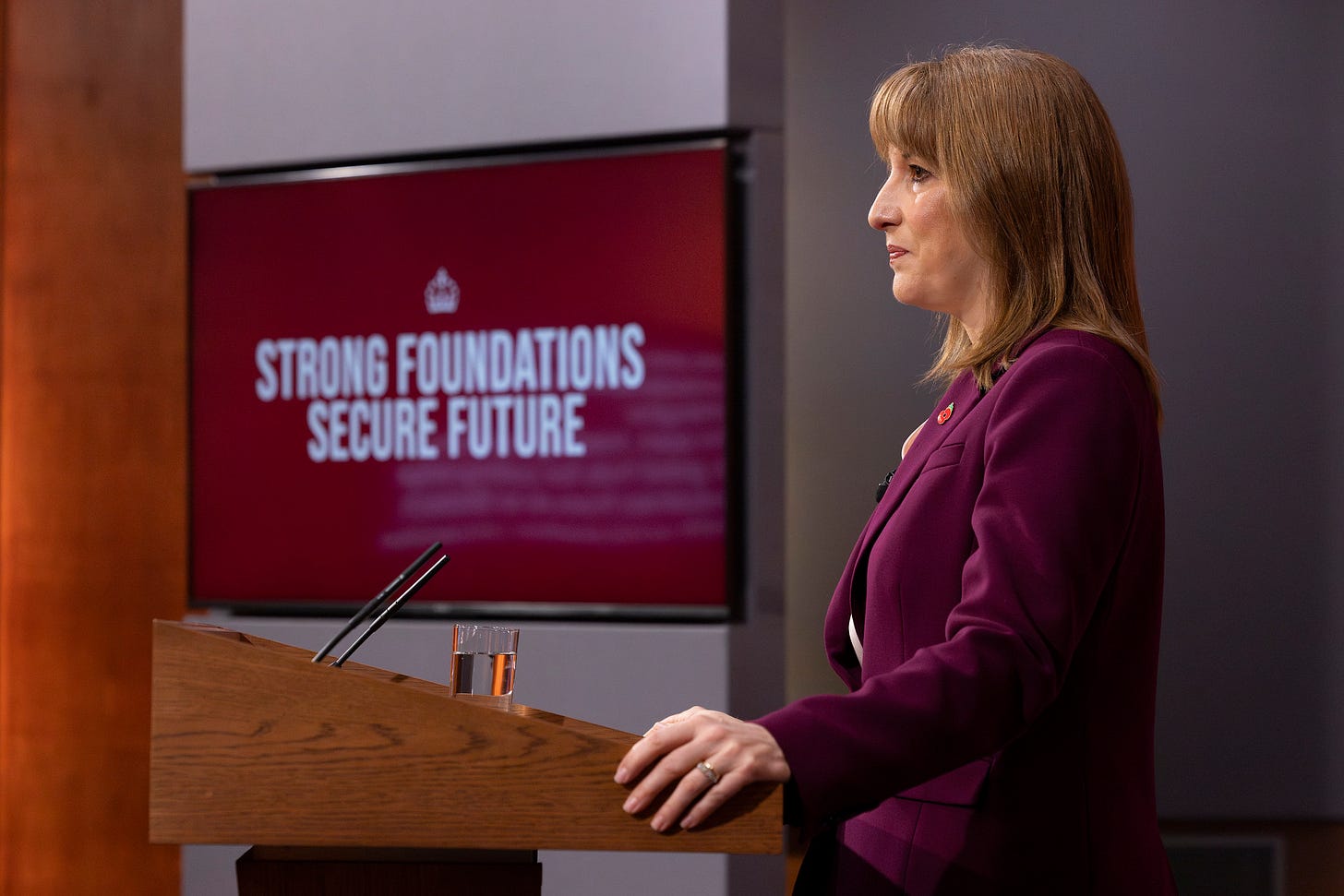

Rachel Reeves is indispensable. Or, at least, that’s the line she’s going with. When pressed by journalists and restive backbenchers, the chancellor likes to stress that it is she — and by implication only she — who is trusted by the markets. And that is because her commitment to the fiscal rules is “ironclad”. To be fair, this claim is not without merit.

Cast your mind back to early July, when government borrowing costs soared and the pound slumped following a tearful appearance by Reeves at Prime Minister’s Questions. While the market reaction was real, the issue wasn’t that investors suddenly decided the chancellor was too emotional to run the Treasury.

Rather, they feared she might resign or be sacked and replaced by a successor less attached to the fiscal rules. Consequently, Reeves’ personal position was only strengthened by the day’s slightly chaotic events. She has leaned into this narrative ever since.

One Chancellor, Several Guvnors

Every Budget has multiple audiences, oftentimes with divergent priorities. There are backbench MPs, cabinet rivals, ordinary voters, party members, political journalists and even particular newspapers. In recent years, another big one has emerged — the bond markets. This is partly a natural response to the post-Truss, mini-Budget world we all inhabit.

No chancellor can afford, politically or financially, a repeat event, when borrowing costs surged as the markets began to digest the implications of unfunded tax cuts and a vast energy support package. It is also because, frankly, the UK government borrows a great deal of money, and this chancellor has left herself precious little headroom above her famous fiscal rules.

As a result, much of the pitch-rolling in recent weeks has been focused on reassuring the markets that the chancellor is serious about prudence, while also ensuring there will be no surprises come Budget day. After all, the markets cannot reprice the cost of gilts if the entire Red Book has been effectively briefed out in advance. Meanwhile, the days of Budget secrecy (and ministerial resignations in the case of a leak) are long gone.

Keep reading with a 7-day free trial

Subscribe to Lines To Take to keep reading this post and get 7 days of free access to the full post archives.