The price of blinking

Welfare retreat makes tax rises more likely — and even harder to sell

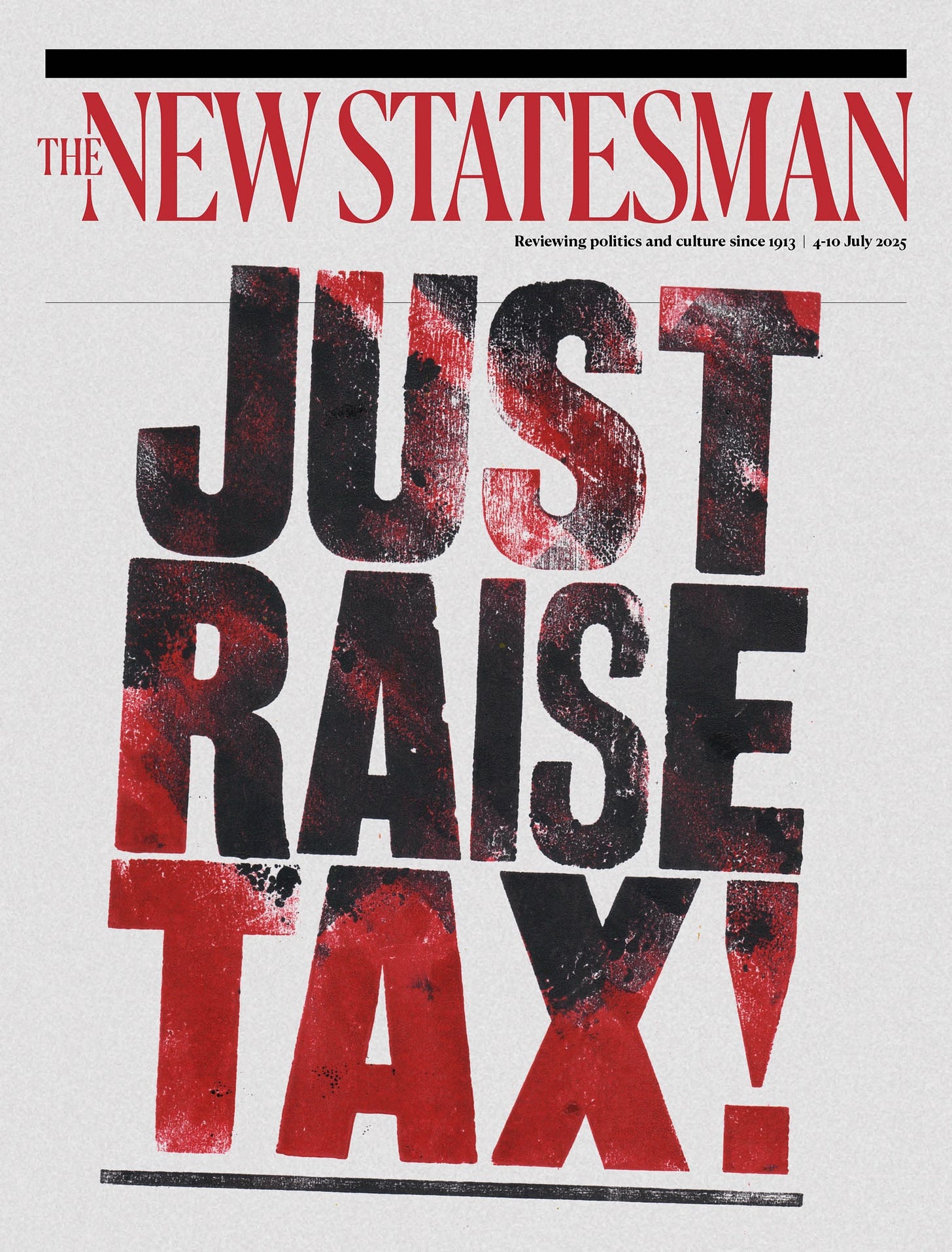

Conventional wisdom is, as the name suggests, widely accepted. Still, it is remarkable how pretty much everyone in Westminster believes that Labour has little choice but to raise taxes in the autumn. A perception unlikely to be altered by the government’s latest (and costly) benefits U-turn. Indeed, this week’s New Statesman cover story ditches any pretence at subtlety.

I have been at it myself. Last week, I wrote a newsletter predicated on a checklist of increasingly implausible assumptions about how Rachel Reeves could avoid raising taxes.

The problem with this sort of analysis, my own included, is that the government is well aware of this! Treasury ministers and officials have access to reams of datasets, many of which resemble the graph belonging to former senior advisor to the president, Milhouse Van Houten:

As Jean-Claude Juncker, former prime minister of Luxembourg and president of the European Commission, famously said of the challenges facing democratically elected governments:

"We all know what to do, but we don’t know how to get re-elected once we have done it."

Death by a thousand downgrades

To describe yesterday’s welfare reform bill as a Pyrrhic victory would be an act of grave disservice to Pyrrhus of Epirus, whose army triumphed against the mighty Romans in the Battle of Asculum — a rather more impressive feat than simply capitulating to the Parliamentary Labour Party.

As a result of last night’s concessions, hurriedly announced at the despatch box by disability minister Sir Stephen Timms, the chancellor faces a roughly £4.5bn black hole. This is on top of the £1.5bn Reeves already had to find following the Winter Fuel Payments retreat1. Now, £6bn may sound like a lot of money, but it pales into insignificance compared with the damage the Office for Budget Responsibility (OBR) may be about to inflict on the government’s finances.

If the OECD or IMF publish a report which downgrades the UK’s growth forecasts, that represents a bad news cycle for the government. If the OBR does it, that has real-world consequences. In its latest Forecast Evaluation Report, published yesterday, Britain’s fiscal watchdog warned that it tended to be “too optimistic” about economic prospects in the medium term, revealing it had overestimated growth by an average of 0.3 percentage points over two-year periods and by 0.7 points over five years.

Given the size of the UK economy, even these small changes can make a massive difference. Consequently, just a 0.2 per cent reduction in the productivity forecast could cut Reeves’ fiscal headroom by £12bn, more than wiping out the £9.9bn the chancellor left herself at last year’s Budget.

The policy was bad, the politics are worse

I’m not wild about the optics or substance of what I’m about to say next. The proposed reforms to personal independence payments would have led to hardship for many people with disabilities. But, given that the government barely made a policy case for the cuts, I’m not sure it falls to this newsletter to do it for them. So instead, I want to turn straight to the political implications of yesterday’s screeching U-turn.

Tax rises are coming. Labour may stick to the letter of its manifesto commitment not to increase income tax, National Insurance or VAT2, but the Treasury has ways of making taxpayers squeal, whether by extending the freeze on income tax thresholds (so-called fiscal drag) beyond 2028 or reducing the £20,000 cash ISA limit. But the failure to reform welfare and reduce the benefits bill makes the politics of tax rises even more toxic.

To make tax hikes even vaguely palatable to voters, the government knew it had to demonstrate it was serious about fiscal restraint. That was the impetus behind some very un-Labour policy choices, such as cutting foreign aid to 0.3% of GNI in order to fund increased defence spending.

The prime minister wanted to show he was doing everything possible — including hurting some of the poorest people on the planet — before even contemplating raising taxes on people, working or otherwise. This contained, I’m afraid, a cold political logic. And welfare cuts were supposed to be next. However, this time, organised domestic opposition — particularly from disability rights advocates — proved more effective.

To be clear, the £6bn or so in benefits savings would have been extremely welcome, given the chancellor’s decision to set herself strict fiscal rules and then proceed to leave herself with a solitary layer of mille-feuille to meet them. But welfare reform was always about more than the money. It was about creating a permission structure to raise taxes.

That strategy has disintegrated on impact. Yesterday’s U-turn has served only to embolden backbenchers, unsettle the markets and make the inevitable tax hikes even harder to sell.

The bill may even end up as a net cost to the Exchequer

It has in my view already broken the spirit of the pledge, by raising employer national insurance last year, but full marks for getting away with it

Enjoying the deep data analysis from ‘former adviser to the President’ Milhouse Van Houten and the re-election platitudes of Jean-Claude Juncker, ‘former prime minister’ of Luxembourg and president of the European Commission. And the ‘screeching u-turns’!